3 Reasons Why You Should Use Accounting Software for Your Small Business

Small-business owners don’t always have the available funds to grow their business as well as hire people to take care of their accounting and administration. They often have to roll up their sleeves and get their hands dirty. However, these functions take time to manage and, meanwhile, they’re busy running a business. Many people turn to accounting software to help get the job done themselves, efficiently and correctly. Here are three reasons why you should do the same.

Reporting

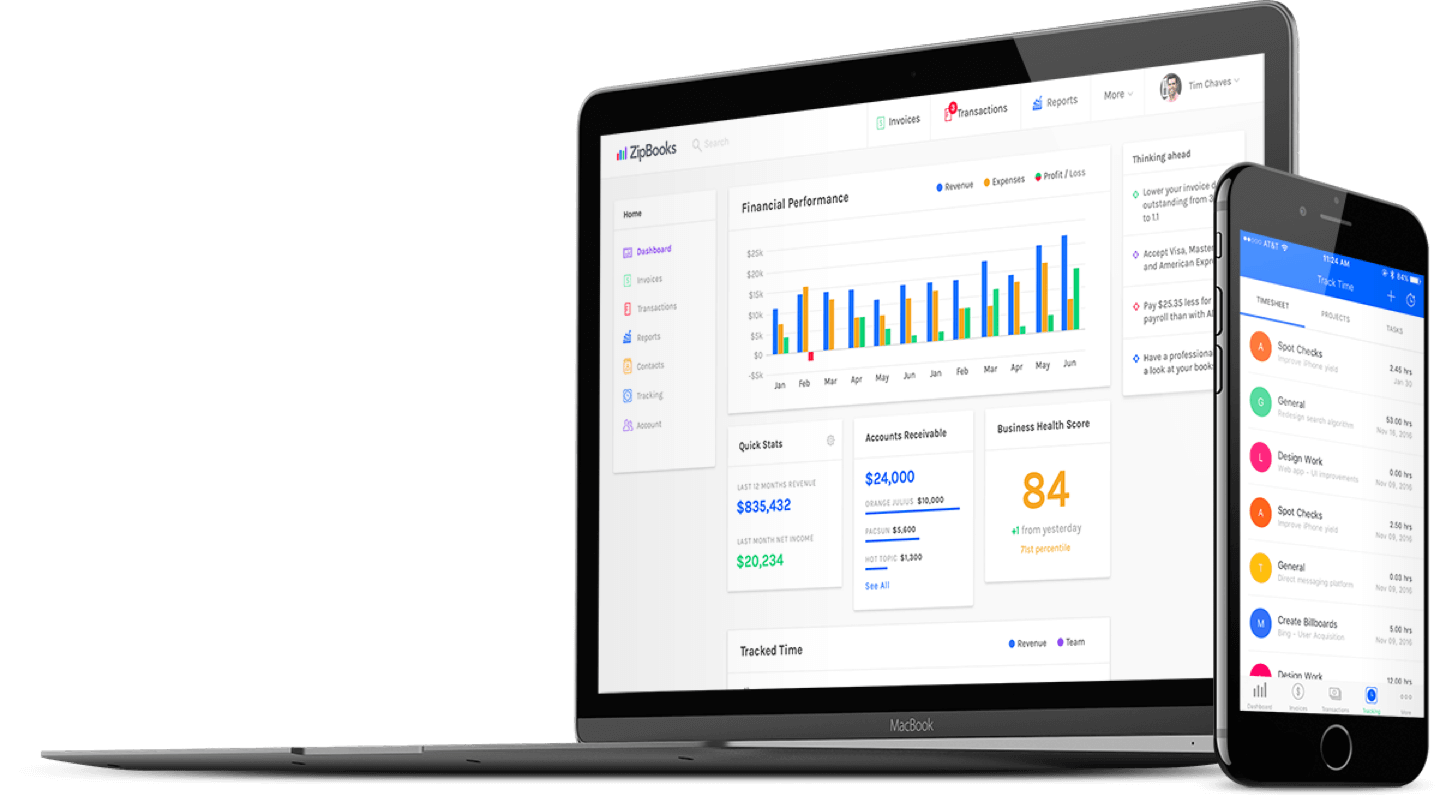

A vast amount of data is accumulated through accounting software. Incomings, outgoings, cash flow, billable hours, tax information – it all contains a lot of insight, but who has the time to trawl through it? That’s where a software package can help. Most come with dashboards to report on whatever information you need. And don’t be daunted if that sounds like a lot to get your head around because an independent Quickbooks training professional can help get you started.

Invoicing

Invoicing can take up precious hours in your day, but accounting software helps you not only stay on top of whom your invoicing, how much and when, but also enables you to produce professional-looking, customized invoices that you can populate and send at the click of a button. Some platforms even offer automated invoicing for those clients who pay a recurring monthly fee. This also helps you expand your payment options too. The more payment options you can offer, the easier it is for customers to pay you.

Expenses

If you have receipts coming out of your ears, there is a solution. Some advanced accounting software enables you to take photos of your receipts as you receive them and upload them straight into the platform. They then correlate the information against your bank transactions and categorize depending on the type of expense it is. You’ll be all set for tax season before you know it.

Take the headache out of accounting by investing a software platform that can do the hard work for you.